How to Save Money on Your Medical Expenses

July 01, 2022

Medical debt in the United States, as of August 2021, was approximately 140 billion dollars, and 45% of Americans state that they would find it difficult to pay an unexpected $500 medical bill.

While medical debt can be challenging to tackle, there are simple ways that you might be able to reduce the cost of your medical bills. So instead of letting medical bills stack up, try some of these simple healthcare savings hacks next time you find yourself facing an expected medical bill.

Reduce medication costs

On average, medications cost the average U.S. citizen about $1,200 per person each year. Switching to generic medications might be able to save you money. By switching to generic medications, you can save up to 30% on the cost of prescriptions, so next time you talk to your physician, discuss moving your medications to generic versions.

Furthermore, there are apps such as GoodRX or RxSaver which offer coupons for many medications, and are a great option for both insured and uninsured people looking to save money on their prescriptions.

Use providers in your network

A provider network is a list of doctors, other healthcare providers, and hospitals that plan contracts to provide care to its members. These providers are referred to as "in-network providers". Because of this contract, you receive lower rates when you receive care from an in-network provider.

By using a provider outside of your network you are taking a risk, insurance companies might add on additional charges. If you're insured, making sure that you use providers in your network is an easy way to avoid extra cost.

To determine if a provider is in your network, contact your insurance company and they can provide you with the information you need.

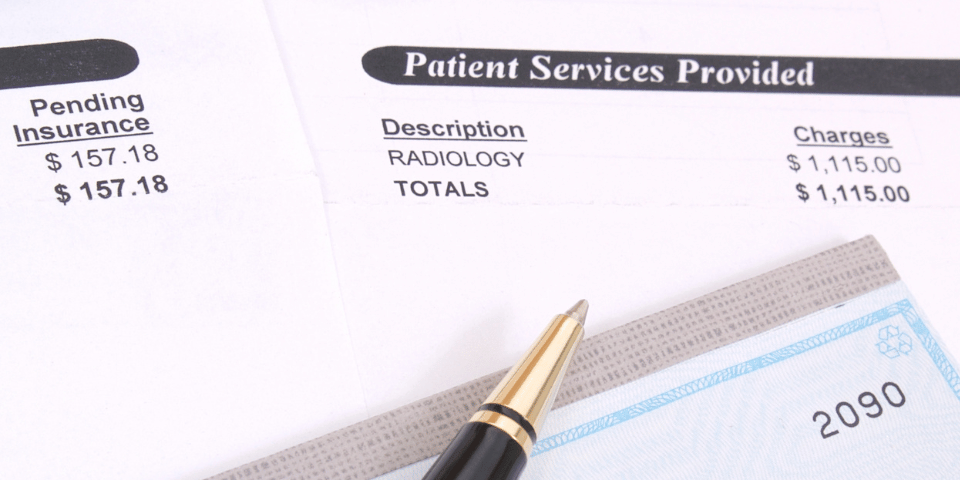

Ask for an itemized bill

Hospital bills have a reputation for being expensive. However, this could be due to the presence of errors within the bill that result in patients being overcharged. In fact, some estimates show that 80% of medical bills contain some type of error. According to NerdWallet, a consumer advocacy group, hospital bills resulted in overcharges as high as 26% on bills that contained errors.

While many people know about itemized medical bills, few ask for them, potentially costing them more money than necessary. Therefore, if something seems awry, it might be smart to ask for an itemized bill.

As simple as it sounds, asking for an itemized bill can help navigate the charges received on your medical bills and help spot errors that can be removed, ultimately lowering the cost.

Shop around

Medical costs can vary drastically. Sometimes this depends on the network, but other times it is based on the facility if there is a procedure involved. Therefore, spending some time shopping around before you decide on a healthcare provider or facility could save you money in the long run.

For example, outpatient care is more affordable than in-patient care. Therefore, if you're having a procedure that can be taken care of in an outpatient center, you can often save time and money.

Another way you might save money is by using an urgent care facility over an emergency room. Urgent care facilities are usually for those who have an illness or injury that are not life threatening.

On average, a visit to an urgent care facility can cost $150. Considering that ER visits can cost anywhere between $600 and $3000, it might be more cost effective to visit an urgent care facility depending on your situation.

Negotiate

Hospitals often charge insurance companies more than uninsured patients, and many hospitals are willing to help those trying to pay their bill. Therefore, negotiation can be key to lowering your medical expenses, and many are unaware that they can do so.

If you plan on paying a medical bill in full, then you might be able to receive a discount when you make the payment. Simply ask the agent for a cash-pay or a self-pay discount, and many providers will oblige.

Conduct your own research

New guidelines require transparency from hospitals on the cost of certain services. You may be able to call the billing department to get accurate pricing information or visit the facility's website.

Know your insurance plan

One of the easiest ways to save money on your medical expenses is to understand your insurance plan. Know what services and medications are covered by your insurance and understand what charges you are responsible for.

One way to do this would be to understand your premiums, deductibles, and copays. An insurance premium is the amount of money an individual or business pays for an insurance policy.

It's also important to note that different services might have different copays, so be sure to check your copayments in your insurance plan. A general rule of thumb to consider is that insurance policies with higher premiums have lower copayments whereas lower premiums have higher copayments.

When signing up for health insurance, it is important to consider these things as it will affect how much you pay in the long run.

Use a Healthcare Savings Account or a Flexible Spending Account

An HSA or FSA can be used to pay for qualified health care expenses. Many employers offer a Healthcare Savings Account (HSA) or Flexible Spending Account (FSA). These accounts function as savings accounts that allow you to set aside pre-tax money for health care expenses.

A key difference between flexible savings accounts and health care savings accounts is that healthcare savings funds roll over at the end of the year whereas flexible savings accounts do not.

Medical care does not just hurt people's wallets, it can hurt their minds. People with medical debt are three times more likely to experience stress, anxiety, and other mental health issues. By ensuring that you're doing the most to minimize your medical debt, you're also avoiding unnecessary stress and putting yourself on a path to a happier, healthier life.