The Financial Pitfall: Impulse Spending and How to Dodge It

When was the last time you made an impulse purchase? Maybe you were scrolling on your phone when an email notification popped up for an amazing “super sale” at your favorite clothing store.

Your key to financial education, lifestyle content and savvy money management.

When was the last time you made an impulse purchase? Maybe you were scrolling on your phone when an email notification popped up for an amazing “super sale” at your favorite clothing store.

Financial literacy is an essential life skill that, unfortunately, doesn't often get the attention it deserves in our education system. As parents, guardians, or educators, it is our responsibility to ensure that our children are well-prepared to navigate the complex world of personal finance.

In today's fast-paced world, information is readily available at our fingertips. If you're looking to gain a better understanding of personal finance, there's no shortage of resources to help you along the way, and podcasts are one of them.

.png)

There are a million things on your plate, so the idea of prioritizing your savings may seem like a daunting task. If you’re struggling to build your savings, you are not alone. According to Forbes, the average American is saving less money now than in previous years.

If you were asked for your credit score right now, would you know the answer? Don’t sweat it if you’re unsure, you’re not alone. According to a survey of 2,000 Americans conducted by OnePoll in May of 2023, one in ten Americans have no idea what their credit score is, and one in five wouldn’t know how to check it.

.png)

Inflation, inflation, inflation. If you turn on the news, the radio, or even overhear chatter in public, odds are the word inflation is floating all around you. If the mention of the word fills you with anxiety, you are not alone. Inflation is an economic phenomenon that affects us all, and it's essential to understand its impact on your personal...

.webp)

The temperature outside is high, but your costs don't have to be. Check out these tips on how to keep your back-to-school expenses under control.

.webp)

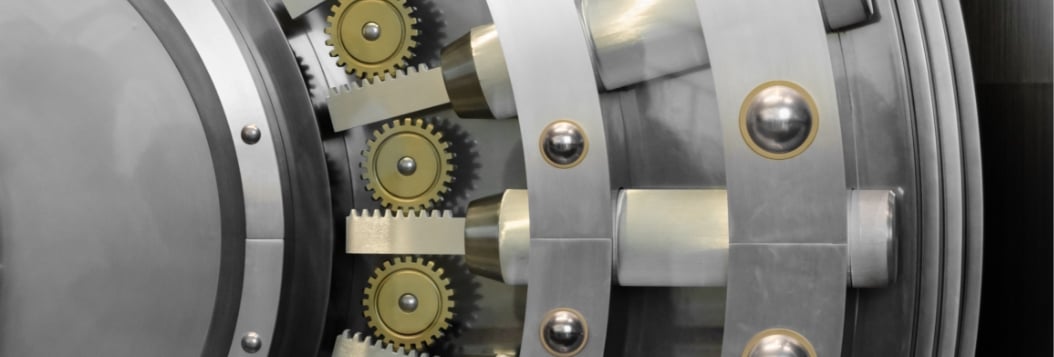

Technology in the banking industry is changing the services offered with checking accounts. Is yours still the right fit for you?

.png)

One day they are saying their first words, begging to be held, and telling you that you’re their best friend and suddenly, they are grown up, and preparing for college.

%202.png)

It’s 2023 and the price of eggs has tripled in the last couple of years, vehicles have increased by approximately 25%, and the price of real estate has increased significantly. It feels almost unattainable to be in a good financial position in our current economy. However, being financially fit doesn’t mean that you make high wages, or that you...

If you click 'Continue' an external website that is owned and operated by a third-party will be opened in a new browser window. EFFCU provides links to external web sites for the convenience of its members. These external web sites may not be affiliated with or endorsed by the bank. Use of these sites are used at the user's risk. These sites are not under the control of EFFCU and EFFCU makes no representation or warranty, express or implied, to the user concerning:

Using a hyperlink may identify you as a EFFCU member to the operator of the external site.

EFFCU does not provide and is not responsible for the product, service or overall website content available at these sites. The privacy policies of EFFCU do not apply to linked websites and you should consult the privacy disclosures on these sites for further information.

If you click 'Cancel' you will be returned to the EFFCU website.